That’s an excellent and important distinction — especially in the context of health insurance consultancy 👇

⚖️

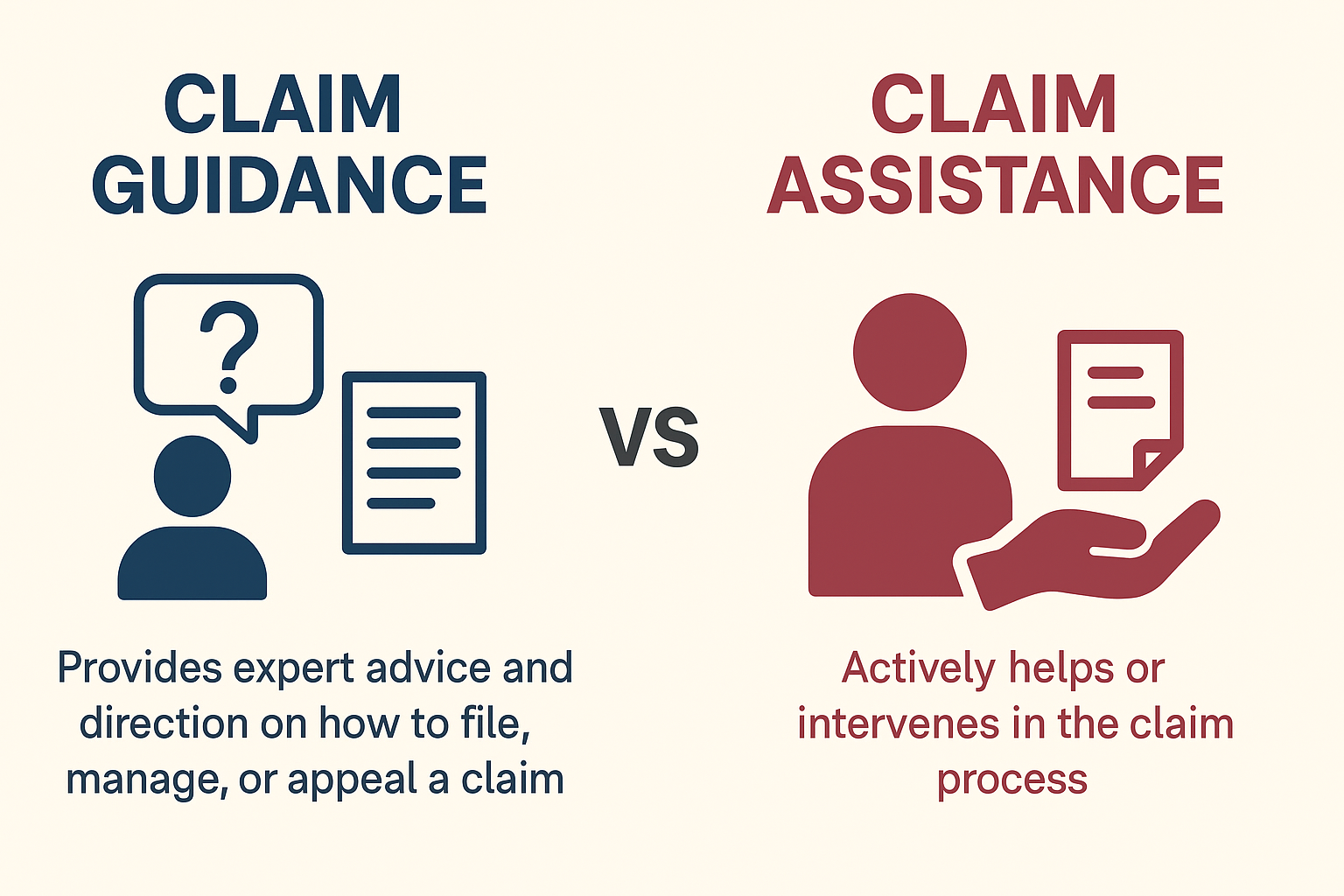

Claim Guidance vs. Claim Assistance

| Aspect | Claim Guidance | Claim Assistance |

| Meaning | Providing expert advice and direction on how to file, manage, or appeal a claim. | Actively helping or intervening in the claim process — sometimes directly coordinating with the insurer or hospital. |

| Nature of Work | Advisory / Consulting in nature. You tell the client what to do and how to do it. | Executional / Supportive in nature. You or your team do it for the client (paperwork, follow-ups, etc.). |

| Example | Explaining how to find claim form, what documents are needed, how to file, and how to communicate with hospital or TPA. | Actually collecting documents, submitting them to TPA, talking to insurer’s claim team, and tracking progress. |

| Responsibility Level | You are responsible for right advice and strategy. | You take operational responsibility for the outcome or process. |

| Who Typically Does It | Fee-based consultants, advisors, or independent experts. | Agents, brokers, or third-party claim service providers. |

| Legal Boundary | You remain within advisory compliance (you don’t represent insurer). | You may act as a representative or facilitator, which might need authorization or POA (Power of Attorney). |

| Fees / Charges | Usually a consultation fee (e.g., ₹1,099 for expert review and guidance). | Often a service charge or commission-based (depends on effort and recovery). |

🧠

Simple Way to Remember

Claim Guidance = Teach the client how to cook.

Claim Assistance = You cook for the client.

In fee-based health insurance consultancy, the correct and compliant term to use is usually “Claim Guidance”, since it focuses on education, direction, and expert review — not direct representation before the insurer.