Health insurance is one of the most critical financial tools in modern India. With medical inflation rising at 12–15% annually, a single hospitalization can drain years of savings. Yet, when it comes to buying a health insurance policy, most Indians still follow the path of least resistance—listening to relatives, believing flashy ads, or relying on agents who sell what benefits them, not the buyer.

The result? Wrong policies, insufficient coverage, and painful claim rejections.

But why does this happen, especially when information and professional advice are more accessible than ever? Let’s break it down.

The Over-Smart Consumer Mindset

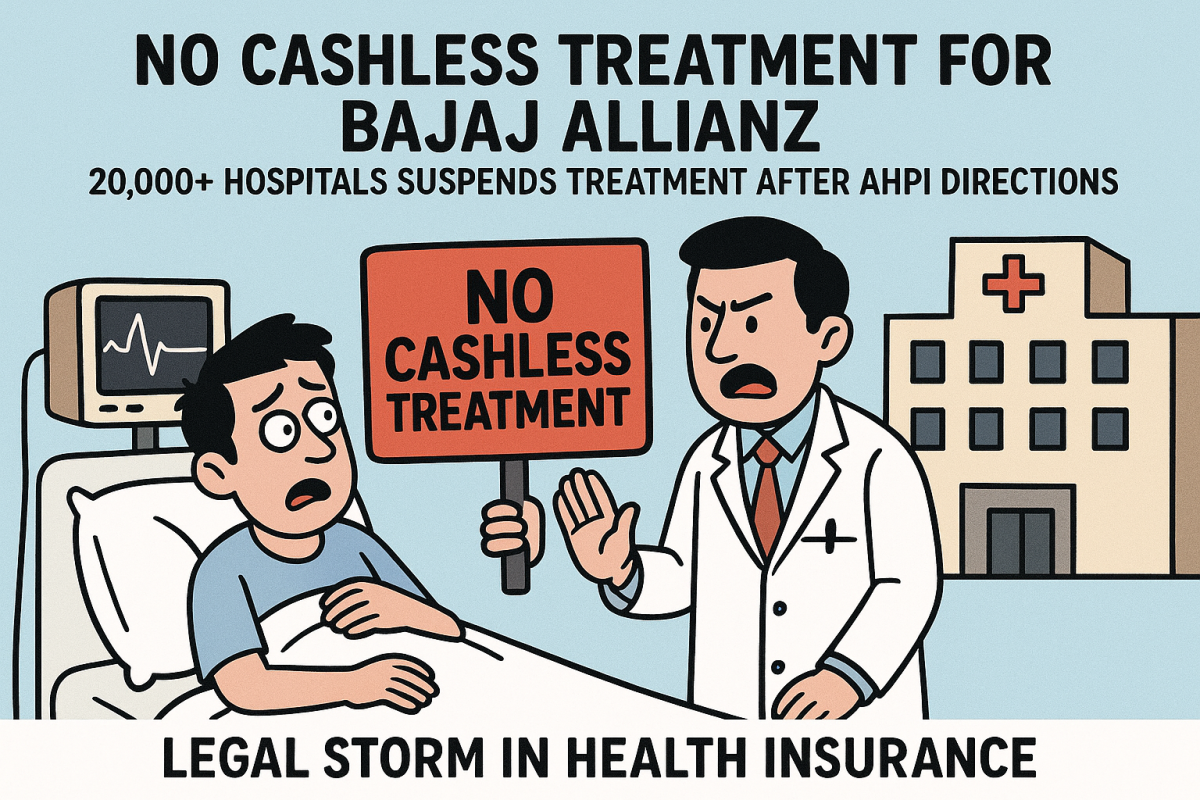

Many Indian buyers believe they know it all after watching a few ads or reading Google reviews. Instead of deep diving into waiting periods, sub-limits, exclusions, or claim settlement history, they get influenced by slogans like “Cashless Everywhere” or “Zero Rejection Guarantee”.

👉 They forget: In health insurance, fine print matters more than flashy features.

The Agent-Driven Culture

India has been a seller’s market for decades. Insurance companies relied heavily on agents, who earn commissions. So, people are used to the idea of “free advice” from someone who benefits when they buy.

- The consultant model is alien to most buyers.

- Paying fees feels unnecessary when someone else is “guiding” them for free—even if that guidance is biased.

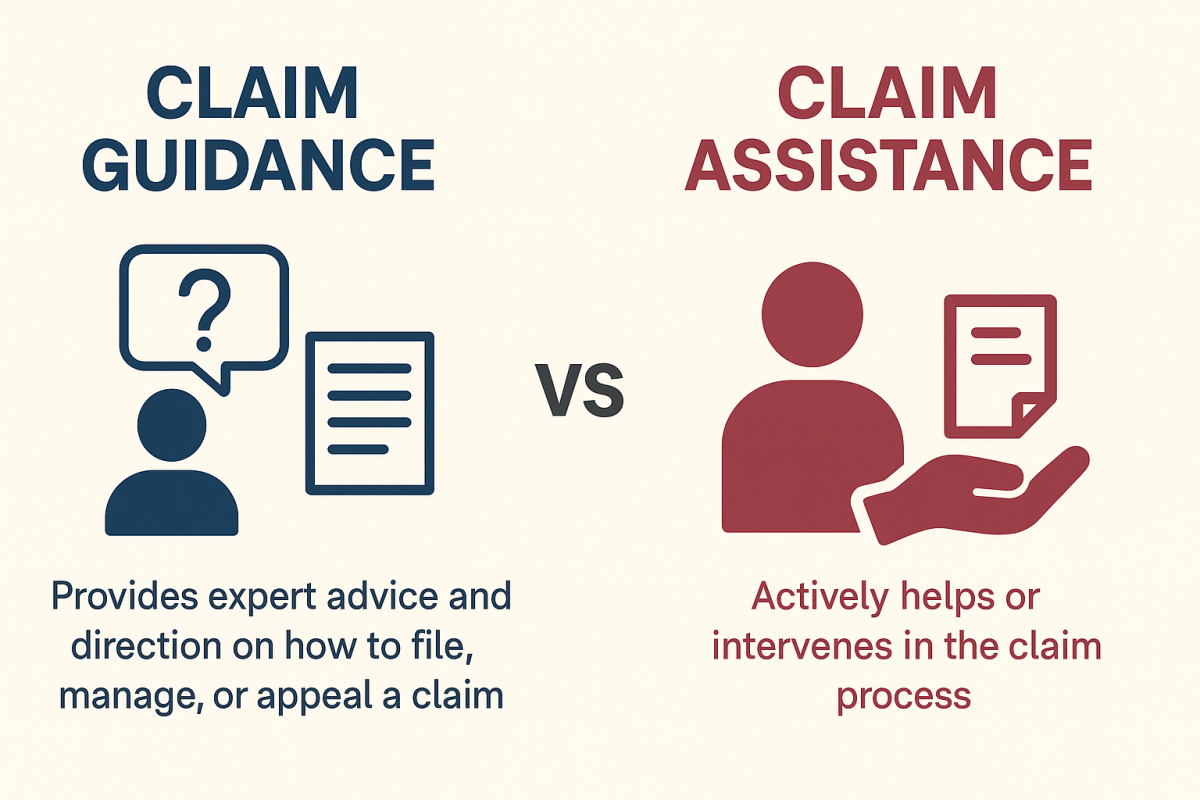

Lack of Awareness About Fee-Based Advisory

In developed countries, financial planners and fee-based consultants are common. In India, the concept is still evolving.

- Most don’t realize that a fee-based health insurance consultant saves them lakhs in the long run by preventing wrong purchases and ensuring smoother claims.

- People assume consultants will “just tell them the same thing” as an agent—without understanding the difference between unbiased advice vs. sales pitch.

Cultural Attitude Towards Professional Fees

Indians hesitate to pay for advice. They’d happily spend ₹2000 on a dinner but hesitate to pay the same for professional consultation that protects their family’s health and finances.

It’s the same reason many don’t hire lawyers until trouble escalates, or don’t consult doctors until illness worsens. Preventive spending is often undervalued.

Information Overload = Confusion

With aggregator websites, YouTube videos, and endless blogs, people think research means skimming through top 3–4 search results. But the truth:

- Online comparisons hide critical policy terms.

- Customer care executives often mis-sell add-ons.

- “Cheapest premium” becomes the deciding factor, ignoring the sustainability of premiums 10–20 years later.

Instead of clarity, information overload makes buyers even more dependent on agents or impulsive decisions.

Short-Term Thinking

Most Indian buyers want instant gratification. They ask: “How much premium today?” instead of “How much premium will I pay at 55, 65, or 75?”.

They don’t project medical inflation, lifestyle diseases, or claim patterns.

Fee-based consultants, on the other hand, bring this long-term perspective—which unfortunately, many buyers don’t think they need until it’s too late.

The Trust Gap

Many still assume consultants might be “just another seller in disguise.” Since agents mis-sold for decades, trust in the industry is already weak. Building faith in a new, transparent model takes time and awareness.

Peer Pressure and Word of Mouth

A large number of policies are bought because:

- “My cousin has this policy.”

- “The office group policy is enough.”

- “The agent is my neighbor, I can’t say no.”

Rational decision-making gets overshadowed by social pressure.

So, What’s the Way Forward?

- Awareness: Indians need to understand that health insurance is not a “buy and forget” product. It’s a long-term financial commitment.

- Valuing Expertise: Just like hiring a CA for taxes or a lawyer for contracts, hiring a fee-based health insurance consultant ensures protection from costly mistakes.

- Mindset Shift: Stop looking at consultation fees as an “extra expense.” It is an investment in risk protection.

Conclusion

Indians don’t research properly or hire fee-based consultants because of cultural habits, lack of awareness, and the lure of “free advice.” But with rising medical costs and complex policies, the old approach is no longer safe.

For professionals, especially in metros, the smart move is to shift towards fee-based, unbiased consultation. Because in health insurance, one wrong clause can cost more than a decade of fees.

Smart professionals don’t buy policies. They buy peace of mind.