That’s a really sharp question 👌 and it touches both Indian consumer psychology and our financial culture. Let me break it down in simple but deep points:

“Free ka chaska” (Love for free things)

- Most Indians feel: “Why should I pay for advice when the agent/aggregator is giving me free service?”

- They don’t realize that the “free” advice is loaded with hidden commissions built into their premiums.

- Psychologically, paying a fee upfront feels like a loss, but paying higher premiums indirectly doesn’t pinch.

Over-smart consumer mindset

- There is a perception: “Main sab samajhta hoon, mujhe consultant ki kya zarurat?”

- Thanks to Google, YouTube, and aggregator websites, people think they are already experts.

- In reality, they see only the surface (premium, room rent, cover amount) but miss critical terms (co-pay, sub-limits, exclusions).

Distrust in advisors

- Historically, Indians have been cheated by agents mis-selling LIC policies, ULIPs, chit funds etc.

- This has created a mindset: “Sab apna fayda dekhte hain, main khud hi decision loonga.”

- Ironically, instead of choosing unbiased consultants, people avoid paying anyone and end up trusting salespeople who work for commission.

Short-term money saving, long-term loss

- A fee of ₹3,000–₹5,000 looks like a big “waste” to many.

- But they don’t see how a wrong health insurance choice can cost them lakhs in claim rejection, hidden exclusions, or annual premium hikes.

- Example: Saving ₹3k today → Losing ₹3 lakh tomorrow in a rejected claim.

Social Proof & Herd Mentality

- Very few people in their circle have used fee-based consultants, so they don’t trust the concept.

- If a friend/colleague says, “Yaar, I took policy from XYZ aggregator for free”, it feels safe to copy rather than try a new professional model.

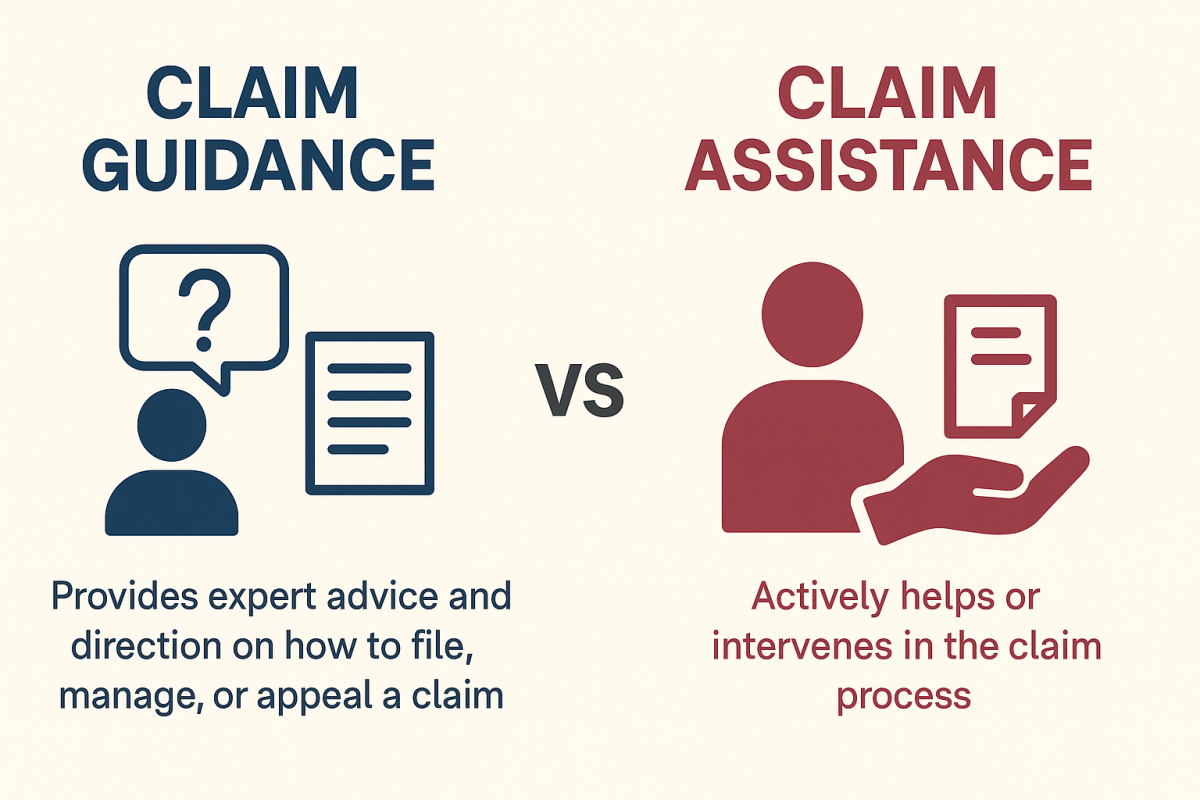

Confusion between “Agent” and “Consultant”

- Many don’t understand the difference between:

- Agent = seller, earns commission.

- Consultant = advisor, earns fee only.

- To them, everyone is just an “insurance wala”.

Cultural Mindset of Bargaining

- Indians are trained to negotiate and get discounts.

- Paying a fixed professional fee feels like “no scope for bargaining”.

- They’d rather believe they got a “better deal” by avoiding a consultant.

✅ In short:

Indian consumers try to be “over smart” because they think they are saving money and outsmarting the system. But in reality, by avoiding fee-based consultants, they often fall into the trap of biased advice and long-term financial loss.